One of the most frequent questions asked is “What’s the difference between cycle specific insurance, to just adding a bike onto your home insurance policy?”

We can understand why this is asked. Often it seems like a cheaper option to just add a bike onto your existing home insurance but are you aware of how the cover differs between the two? Check out Bikmo’s handy video below on what to look out for:

Policy wording can often be a minefield to understand. We have made ours as simple as possible; not all insurers do.One area that causes confusion is the cover and exclusions for ‘cycles’.

Read your home insurance policy wording carefully, as you may find that the definition of ‘cycle’ changes to ‘sports equipment while in use’ in the exclusions section.

It is important to check this, as it may mean you are not covered while actually riding your bike.

With your home contents insurance, there will almost certainly be a limit on the value of cycles, which could be as low as €500. If your bikes are worth more than this limit, they may need to be specifically declared on a home insurance policy, and they’ll want an additional premium. In many cases, home insurers will decline to provide cover for high value bikes. Bikmo‘s Triathlon Ireland cycle insurance provides cover for bikes valued up to €30,000! Triathlon Ireland members benefit from an exclusive 7.5%* discount.

Some household policies will not provide cover for accidental damage or theft whilst the bike is away from the home, which is probably when you need it most! Few also cover your bike when it’s outside of Ireland – does yours? We cover away from home as standard, providing it’s locked securely in line with our locking requirements. Check out our handy locking requirements video below and Bikmo’s full locking requirements here.

Many cyclists assume it is only theft that they’ll need to be protected against when it comes to cycle cover. However, at Bikmo, 44% of all claims from 2022 come from accidental damage while riding the bike, a factor many home insurers don’t cover against.

With a jersey, shorts, warmers, helmet, glasses and shoes, cycling kit can often be close to your bike’s value! Clothing is usually the first thing to make contact with the tarmac in a crash. Check the policy wording to see if your other expensive kit is covered.

Whether you ride sportives or race downhill, many of us like to race against the clock or competitors. Your home contents policy may exclude damage caused when taking part in competitive or mass participation events, and they’ll almost certainly turn down a claim if your bike is stolen from a race transition area. Bikmo‘s cycle insurance is tailored for cyclists to choose their level of cover for the type of events they ride, whether a triathlon road race or sportive.

When using your insurance, the last thing you want is to be stung with a sizeable excess when claiming. Home insurers often apply high excess fees that can be up to the value of £500. With Bikmo, where available, you can opt to have €0 excess on bicycle claims when you replace through our retail partners.

We often lend our bikes to friends, when they’re new to cycling or if a mate is in a fix before a race and needs a bike. A home insurance policy will be in your name, so if you make a claim for damage or theft when you have lent the bike to a friend, the insurers may not pay out. Bikmo’s cycle insurance covers your bikes as long as you’ve given your permission for a friend or family member to use them.

Your bikes may be one of the lowest-value items on the home insurance, but that doesn’t mean you won’t be stung with a hefty increase to your annual premium following a claim. Home insurers often increase your premium the following year if you have made a claim. Making a claim with Bikmo’s cycle insurance usually won’t affect your home insurance policy.

It’s worth checking your home insurance policy, as it may not provide the cover you require, such as:

● Excess costs – home insurance excesses can mean it’s not worth claiming for your losses

● Maximum value – the maximum insured bike value can be as low as £500

● Away from home – there’s often an ‘abandonment clause’ that classes bikes as ‘abandoned’ after only a few hours cycling away from home

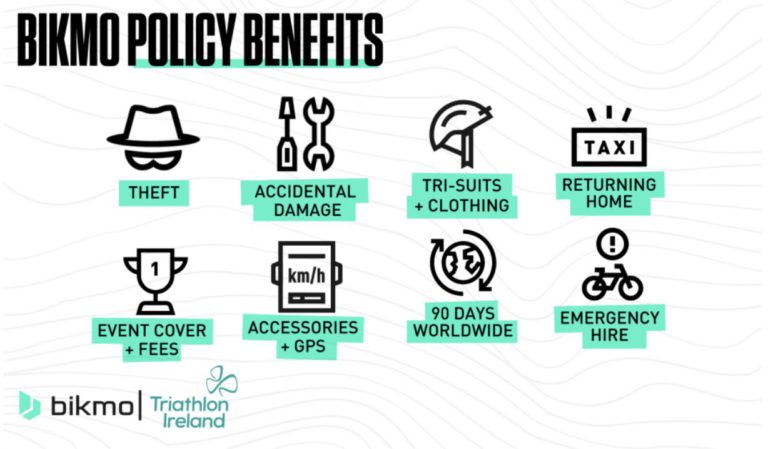

Bikmo’s Triathlon Ireland cycle insurance can cover against:

– Theft and accidental damage of your bike(s)

– Event cover including Triathlons

– Kit and accessories including Tri Suits and GPS devices

Plus, Triathlon Ireland members benefit from a 7.5%* discount on full policies and save 50%* when insuring additional bikes, with the lowest value benefitting from the discount.

More helpful blogs by Bikmo

Disclaimer – Coverage is true as per a web search on 10/10/2023. All coverage is subject to terms and conditions.

*Minimum premium €5/mo and policy wording applies. This promotion is provided by Bikmo GmbH is authorised/licensed by the Industrie- und Handelskammer München in Germany and is regulated by the Central Bank of Ireland for conduct of business rules.Disclaimer – Coverage is true as per a web search on 10/10/2023. All coverage is subject to terms and conditions.

Women in Sport Week (WIS Week) returns this March, and Triathlon Ireland is proud to celebrate the incredible contribution of women and girls in sport.

All Triathlon Ireland coaches are accredited by Sport Ireland Coaching. Find out more about how to find an accredited triathlon coach here.

Triathlon Ireland invites all Age Group Athletes to join a free online Clean Sport Webinar designed to help athletes compete with confidence and integrity.

Triathlon Ireland Youth Awards – National Triathlon Centre Join the Triathlon Ireland Youth Awards on Sunday 1st March 2026 at the National Triathlon Centre (NTC), University of Limerick. We are delighted to confirm that the Youth Awards Day 2025 will take place on Sunday 1st March 2026 at the National Triathlon Centre, Limerick. This daytime…

Triathlon Ireland have an exciting job opportunity for a part time Leinster Community Development Coach.

Join the Triathlon Ireland Youth Awards on 1 March 2026 at the National Triathlon Centre, Limerick. Morning activities followed by awards.

Please note that by using our websites, you accept the terms of this Privacy and Cookie policy. You can choose to set your browser to refuse cookies from any of our websites but as a result, you may lose some functionality or website features. More information about cookies and details of how to manage or disable them can be found on www.aboutcookies.org.